Stock Charts Free and Stock Scans at TruCharts.com: Stock Buy/Sell Strategy Signals:

Here is the report from our trade strategy sorted by volume. These are stocks that generated a buy signal yesterday from one our fast trading strategies - check the open on all these stocks today and you will see all of them opened positive and you could have made money in these stocks.

Showing posts with label Stocks to watch. Show all posts

Showing posts with label Stocks to watch. Show all posts

November 21, 2014

November 14, 2014

Trucharts.com Buy Strategy signal for AMZN

Trucharts.com AMZN stock update:

Stock Charts - Predefined Stock Scans - Trucharts.com - AMZN stock update: (Stock Trading Strategy); StockScreener.

Check here below our buy/sell strategy for AMZN - we had a buy signal around 305 and today the stock is up to 327 a move of over 5% in less than 4 days - this strategy is available for free at our site for registered subscribers.

|

| AMZN Stock Chart with BUY signal |

November 12, 2014

Trucharts.com positions update

Our position calls on YHOO are still doing well. We had picked YHOO at 38. We bought YELP this morning when it dropped at around 60.6 - position is down now - we will watch this closely - technicals are still positive MACD and RSI.

Check the chart at: www.trucharts.com/stockview.aspx?TICK=YELP

We are still long T, USO, JRJC and short AEM, IBB and looking to short LUV and GM.

Trucharts Team

Check the chart at: www.trucharts.com/stockview.aspx?TICK=YELP

We are still long T, USO, JRJC and short AEM, IBB and looking to short LUV and GM.

Trucharts Team

November 11, 2014

Trucharts Invitation

Trucharts.com

We invite all to check out and use the site and susbcribe for free. There are so many features to help you to learn to start investing in stocks and make sound investment decisions. Check it out and start with some basic charts - and start a virtual portfolio on our site and monitor your progress. Portfolio is accessible after you sign up.

Also check our special subscription offer for the holiday season.

You can find many excellent technical analysis tutorials at this page:

http://finance.yahoo.com/video/playlist/talking-numbers/;_ylt=AwrSbD6xd2JUcGsA.k1XNyoA

November 10, 2014

Trucharts.com - Stockwatch List

Turcharts.com - Stocks to Watch List

Here is our list of stocks to watch for this week:

NSC - Up today $3 - our buy signal triggered on Friday and shown in our blog

ABBV - Up today $2

XOP - down - but we think consolidating

T - moving higher

MO - hitting new highs

JRJC - China allowing foreign investors access to China markets

USO - Consolidating - watching closely to see breakdown or move up

WSM - Watch closely - earnings expected 11/19

Trucharts Team

November 9, 2014

Trucharts.com - Stocks to watch week of 11/10 and Blog Update week ending 11/7/2014

Trucharts.com - Blog and markets Update for week ending 11/7/2014

Mid-term elections done - well the GOP won and now we have to see their agenda. Employment news - which was so-so and with that we had, oil rallying after being trounced, gold rallying on Friday after hitting new lows and the gold miners rising. Markets hitting new highs and VIX dropping (as we had been indicating for quite some time) - we still expect the VIX to drop and markets to consolidate their gains here and breadth is narrow. Markets are heading into a strong cycle - end of the year when holiday season starts and into the new year. We do expect to see some pullback from this big move, but move to new highs is still in the cards. With the Fed staying put on interest rates, we do not expect any type of major pullback in the markets. The Fed will not raise rates till next year - and that will drive the markets' direction. With no other avenues to make good returns, investors have no choice but to put the money into markets and now the BOJ announced a round of stimulus to put money into stocks - that just gives the markets more impetus to move higher. Pockets of strength still exits and we need to take advantage of these.

We are looking to the following sectors and stocks next week. Oil and energy stocks/ETFs, gold miners for short term trades.

We have added a very helpful feature on our site to help and assist our users on how to use each page and a description of each field on the page. Please check this image below for this feature - it is on each page of our site now (except home page which is under re-design).

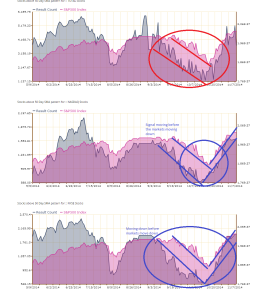

Here we wanted to show below how the sentiment charts from our site predicted this massive move up and the correction we experienced 3-4 weeks ago in the markets - note the drop in the stocks above 50d SMA before the markets actually went down and then the rise in stocks above 50d SMA before the move up in the markets. The signals are very clear prior to the market moves - we have highlighted these with the trend lines. You can see clearly that we are at a top and a sideways market for the next few weeks and possible pullback prior to thanksgiving. As you can see the stocks above 50d SMA is moving down and we are in a topping mode for the markets. We have several such indicators for all the reports we generate on our reports page:

Here is our list of stocks to watch for the coming week:

Buy SIgnal: www.trucharts.com/stockview.aspx?TICK=XOP

www.trucharts.com/stockview.aspx?TICK=NSC

www.trucharts.com/stockview.aspx?TICK=TGT

www.trucharts.com/stockview.aspx?TICK=DO (watch)

www.trucharts.com/stockview.aspx?TICK=ETP

www.trucharts.com/stockview.aspx?TICK=CNQ (short term trade)

Good luck trading.

Here is the udpate from our hedge fund manager for his performance from last week (cumulative return for a $50000 account):

November 7, 2014

Trucharts Special Subscription and Stocks to Watch Update

Stock Charts Free - Our subscription offer to our site is normally $180 for 1 year and we are offering it at $90 for one year a 50% discount. 12 MONTHS (FLAT 50% OFF). This is the best deal you will see and learn how to make money using our blogs, and the site trading strategies. We have users joining us and moving away from other sites. This is a Special Holiday offer.

Stocks we picked yesterday: RRC, USO, TIF, BABA are all up today.

Our AEM short is not an issue since we sold the put and we think the gold jump is a dead cat bounce for the short term. Long term trend is still down.

Trucharts team

October 31, 2014

Trucharts - Stocks to Watch and Hot Stocks 10/31/2014

Trucharts - Stocks to Watch and Hot Stocks 10/31/2014

Stocks to watch - 10/31/2014 -

SBUX - weak earnings

VECO - weak earnings forecast

ED, PCG, SO and utility stocks

Short gold and gold miners

Long AAPL, MA and V, T - WILL LOOK TO GO LONG MA ON PULLBACK

Biotech crowded trade - take profits.

Watch USO and oil stocks here closely.

Trucharts Team

Subscribe to:

Posts (Atom)