Showing posts with label ALGN. Show all posts

Showing posts with label ALGN. Show all posts

June 23, 2020

January 6, 2019

Schizophrenic markets, Fed Reserve, Powell and markets moving up, FAANG stocks

Schizophrenic markets, Fed Reserve, Powell and markets moving up, FAANG stocks

Well the man with balls - lost them over Xmas and New Year's eve - you know who we are talking about - none other than good old Powell himself.. I guess he had a good chat with grandma Yellen and good old bubble maker Bernanke himself and suddenly had his balls chopped off for being too aggressive and making the rich poor - oh we feel for the rich!!! What a fucking joke. Markets gyrating 1000 points in a day, 700 points - guess we have to get used to these type of moves. And then we have the blabber heads on TV trying to explain these markets. And non stop talk about the Fed and their constant analysis - just annoying - it would be nice to have a channel where no one says anything. Yet have you heard anyone yet mentioning that the bubble is falling apart. Somehow the Fed roll off the balance sheet is now being questioned after the teachers of Powell (Yellen/Bernanke) made some noise on Friday and everyone was excited. Again we are coming off very oversold conditions and several stocks are bouncing of key moving averages. We like any stock here for the short term - normally all stocks in the indices will move with the move up. so the FAANG stocks are also good for the ride up. Banking stocks look strong on charts - again be mindful - we are talking about some short term moves here and these can be used to trade intra-day and for overnight positions. Obvious names come to mind - FB, GOOG, SHOP, GRUB, NFLX (which moved up and we think it is going to 300). There are many other heavily shorted stocks that also have high betas.

Here is an article worth reading:

https://www.zerohedge.com/news/2019-01-06/ugly-truth-you-wont-hear-fed

The AAPL news was expected - it was obvious based on the suppliers indicating that their biggest customer (as if this was a big secret) was canceling orders - so the news from AAPL should not have shocked anyone and it was also obvious when the stock started falling after the last earnings report. As expected the stocks dropped and the once darling of Wall Street lost a total of over 350B in market cap value - that is the whole market cap for FB - and we say the markets are not over-valued or expensive - this is actually happening - everyone is in equities and the ETFs do not help - we think ETFs should be banned - these distort markets and are really another way for Wall St to just make more money. How are these different from mutual funds - there is really no difference.

AAPL will need to change its approach on the next generation phones and there is nothing new on the horizon and specially this paying $1000 for a phone days are over. These companies need to start realizing that after a certain point - (same as computers) - people are not going to pay up for small feature improvements and there is a lot of competition in this space. Competitive phones are cheaper and better. A good phone should be no more than 500 - yet all these companies keep pricing themselves out of the markets. As you can see Samsung and AAPL are losing market share to Chinese competitors all around the world and we expect that prices will trend downwards as we may have reached the peak with IPHONE X.

There will be backlash as ordinary customers will stop paying these high prices being pushed onto them. This is going to be the next computer - lots of competition and prices will start to come down. There is a lot of buzz around 5G - we expect some noise around this - but it will be short lived. Prices will not be going any higher from here on forward. This means it will impact margins not just for AAPL, Samsung and others - but also their downline suppliers - they will be put under pressure on component pricing.

We would trade the markets here as earnings season is upon us - watch the man without the balls now - Powell - who changes his tune every couple of weeks. He is like a management trainee..

We are expecting to launch our new revamped site with new features and buy/sell directly from our site towards the end of Jan - slight delay to our original planned date.

Time to go and make some money.. Good luck trading.

HAPPY NEW YEAR 2019..

Trucharts team/Founder (Co-founder Jetstox.com)

Here is an article worth reading:

https://www.zerohedge.com/news/2019-01-06/ugly-truth-you-wont-hear-fed

The AAPL news was expected - it was obvious based on the suppliers indicating that their biggest customer (as if this was a big secret) was canceling orders - so the news from AAPL should not have shocked anyone and it was also obvious when the stock started falling after the last earnings report. As expected the stocks dropped and the once darling of Wall Street lost a total of over 350B in market cap value - that is the whole market cap for FB - and we say the markets are not over-valued or expensive - this is actually happening - everyone is in equities and the ETFs do not help - we think ETFs should be banned - these distort markets and are really another way for Wall St to just make more money. How are these different from mutual funds - there is really no difference.

AAPL will need to change its approach on the next generation phones and there is nothing new on the horizon and specially this paying $1000 for a phone days are over. These companies need to start realizing that after a certain point - (same as computers) - people are not going to pay up for small feature improvements and there is a lot of competition in this space. Competitive phones are cheaper and better. A good phone should be no more than 500 - yet all these companies keep pricing themselves out of the markets. As you can see Samsung and AAPL are losing market share to Chinese competitors all around the world and we expect that prices will trend downwards as we may have reached the peak with IPHONE X.

There will be backlash as ordinary customers will stop paying these high prices being pushed onto them. This is going to be the next computer - lots of competition and prices will start to come down. There is a lot of buzz around 5G - we expect some noise around this - but it will be short lived. Prices will not be going any higher from here on forward. This means it will impact margins not just for AAPL, Samsung and others - but also their downline suppliers - they will be put under pressure on component pricing.

We would trade the markets here as earnings season is upon us - watch the man without the balls now - Powell - who changes his tune every couple of weeks. He is like a management trainee..

We are expecting to launch our new revamped site with new features and buy/sell directly from our site towards the end of Jan - slight delay to our original planned date.

Time to go and make some money.. Good luck trading.

HAPPY NEW YEAR 2019..

Trucharts team/Founder (Co-founder Jetstox.com)

Labels:

AAPL,

ADBE Service Now - NOW Stock,

ALGN,

ALibaba stock,

AMZN,

BABA,

Blog,

FB,

Fed,

Fed bubbles,

Fed in a corner,

Free Stock Charts,

HD - Home depot,

NFLX,

NVDA,

NVDA chart,

Options Strategy

November 18, 2018

Our latest thoughts on markets, Bubbles, Housing, NVDA

Our thoughts on housing, NVDA, ALGN and bubbles:

Written on 11/01:

Housing Correction coming, Bubbles, and how we held our NVDA short for over 2 years - patience is a virtue in the markets - what stocks look vulnerable and why we think HD is going to less than 50.. Well, what we expected finally happened - fortunately we were prepared for this big move down and we think more is coming - we used our indicators to monitor and these were confirmed once the move down was triggered. We believe this pullback and move down could last longer than anyone thinks. Bear market rallies are fierce and vicious, and these tend to fool the ones who are still hanging on to their hats, praying for the move up so they can liquidate their positions which were acquired a lot higher. Unfortunately praying and hope are not the answer.

We have shown here our short portfolio and our long/short portfolios below..

We know that there are some impeccable indicators that clearly show we were approaching a top in the markets - here they are: AMD stock - Masayoshi investing money like it grows on trees (which we guess is partially true), and ETRADE ads on TV showing trading can make one a billionaire.. Very standard ads - we live in a world where we are easy to forget the past, and repeat the same mistakes in a different form at a later time with a different group or generation of folks.. It is called wash, rinse and repeat - the big guys know it and they play the game well. Suck in everybody - make them high and drunk - then kick them out onto the road.. Works perfectly.. been there done that.

We have been warning for several weeks now that we are experiencing one of the most massive bubbles ever - ridiculous valuations - excessive risk taking with no regard for risk. Eventually someone has to pay for all this money printing. We believe the Fed has realized there is a massive bubble in stocks and is focused on pricking the bubble. Well, they are succeeding. Not a single soul and crackhead on TV has uttered the word bubble - CNBC, Bloomberg - you name it - all these assholes come on TV acting like they are gods of the stock market - everyone of them is a pump and dump ass.. Trust us - we know this very well - when one analyst came out and pumped up NVDA - all the asses on TV said it is going higher.. It is the most expensive semiconductor stock in the world - trading at over 15 time P/S - there is ZERO justification for that and guess what my favorite top of the market indicator did - that Masayoshi idiot invested in NVDA. We had shorted it all the way up at every 20% move and then also bought the long term puts. Agreed that we missed this bull run - but sometimes you have to use your gut and sit through it - trust us - we have learned patience from markets. And this mistake will never happen again.. We know how to manage such a situation much better next time around. BTW - whatever happened to that analyst - did he get fired - nope - we know that in these firms, the firms will be short the stock, and then their analysts will come and put a buy on the stock while the firm is shorting at the same time.. It is a well known technique/practice - but will never get out to the public - well now you have it. Another one of our favorite shorts and overhyped stock ALGN - what a joke - company does 2B in revenue and market cap was over 35B - how does this make any fucking sense.. (We are allowed to cuss in our own blog!!) - I can tell you people lost their shirts in this stock as it dropped over $80 in a week and over $170 in 4 weeks. Margin calls are running around the trading desks.. We were long ALGN puts right before earnings.

Housing in Bay area - here is our open prediction - a 30% correction is coming.. We said it and are putting it in writing.. There is a 100% stocks to housing correlation in Bay Area and once all of the stocks come back down to earth - so will housing prices - we are already witnessing price reductions of over 100K in a week for eager sellers.. Unheard of again - where people were jumping over each other to overbid and paying top price of over 200K-300K on average over asking - now there are no buyers - whoever is out buying - is going to regret it very soon.. Just a 20% reduction in price will instantly eliminate all your equity.. It is coming - wait and watch. This is the main reason we think HD stock has to go to 50.. all the days of renovation and flipping are coming to an end.. The SALT and HELOC deductions will devastate the Bay Area - watch - Trump knows it. Prices are coming down in NY, Denver, Australia, Hong Kong, Canada, UAE and India.

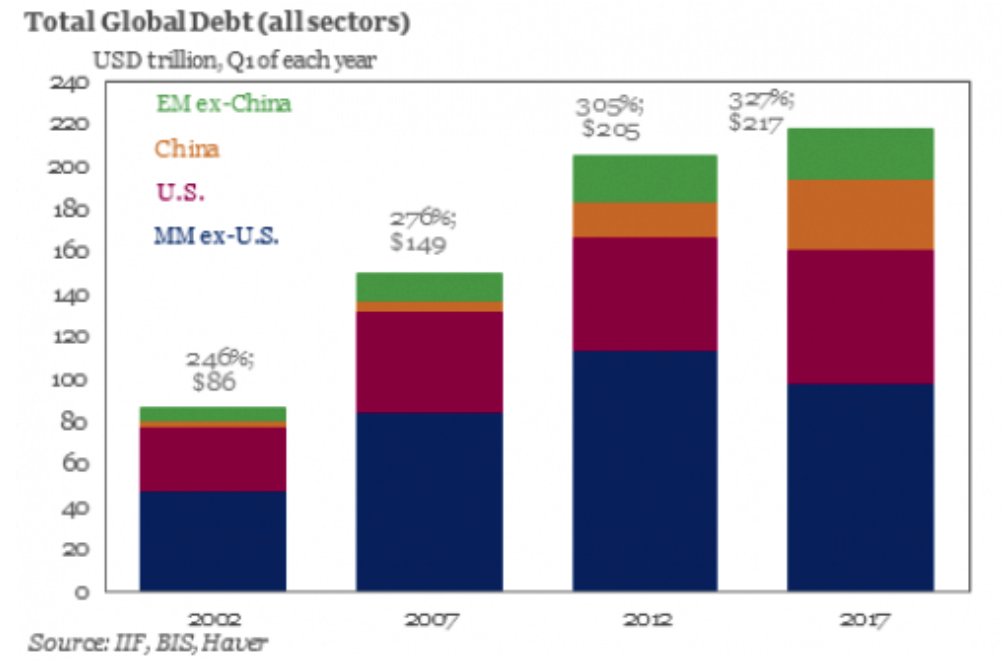

We are short and stay short NVDA, ALGN, NOW and many more overhyped and overpriced stocks. We will buy when there is blood on the streets.. It is unfortunate that many people will end up losing (wise ones will sell and take their profits) while all the suckers who are still drunk and high at the party will be stuck with a big shock.. It is also unfortunate that the Fed and all Central bankers have made the world (along with China) addicted to bubbles.. They have not learned that human behavior does not change just because of a single or two incidents (2000 and 2008 crash) - people will take more risk when money is flowing like water.. No one is talking about all the pension funds, government liabilities, and many more government entities that will suffer consequences of bubble markets - it is sad and it would have been better had the Fed and central bankers had taken a more gradual slow and steady approach - we might have been in a much better position. Yet they do the same - wash , rinse and repeat.. So take profits while you are up - and do not end up crying later..

We will be announcing an amazing offer for equity trading from our site directly very soon - an unbeatable offer - that will rock your brain.. It is coming - stay tuned.. and keep checking our site..which will also be completely revamped..

Also check our call on Chinese Yuan to USD targets on our twitter handle @trucharts where we post our trades and our previous blogs.

BTW - sell AMZN and we are short NFLX.

Short portfolio link on Twitter handle - (@trucharts)

https://twitter.com/trucharts/status/1063793651552182272

Long portfolio:

Good luck trading..

Founder/CEO/Team at Trucharts.com

October 7, 2018

Tech Stocks - Alibaba (BABA) and China/Semiconductor Stocks Updated/Fixed for fonts

Tech Stocks - Alibaba (BABA) and China/Semiconductor Stocks

First disclosure - We missed this bubble and are really upset that we missed it - made money in the last two bubbles but did not see this one even though it was staring us straight in the eyes. But this was an important lesson learned and a very expensive one at that. We missed many amazing stocks and that is what upsets us the most.. Truly disappointing..Now back to the markets:What a run up - absolutely amazing - it was a classic up move from a huge pullback from earlier in the year. Every stock was just going up, up and up. There was no stopping the BULL train and indices hitting new highs - many stocks hitting new highs - company valuations crossing $1Trillion - bigger than the GDP of many nations put together.. Yet not one analyst or talking head or journalist (except that 1%) were willing to utter the word BUBBLE. New startups being valued at numbers that exceed the 2000 bubble, funding at levels not seen even in 2000 - Idiot Masayoshi - raising 100B funds like candy.. These are the signs of bubbles - not a single soul is scared or even concerned - margin debt at all time highs. P/S of companies at records - companies making no money being funded as they are going to make BILLIONS.. We have to say these are all signs we have seen and witnessed before and these never end nicely.. We have become addicted to bubbles and we have now perpetuated 3 within a span of 18 years - that is unheard of. Massive money printing and FOMO amongst the VCS, the investing public and machines doing the trading has led to this excess of massive proportions. There is not a single day when a company is going public - which is a sign the smart money (VCs) are cashing out - while everyone is high and drunk.. Some examples of stocks trading at ridiculous P/S - NOW - over 18x P/S; ETSY - over 14x P/S; and there are many more. The numbers of companies trading at these type of valuations is absolutely staggering. And every new company has now a valuation above $1B - it is an absolute joke - NVDA trading at over 170B market cap and P/S of over 15 for a semiconductor company - that is unheard of in the history of semi companies. Full disclosure - we are short NVDA.Here is a comment from ex CEO Scott McNealy from good old Sun Microsystems which eventually went out of business: read the words - they are actually amazing from a valuation perspective:

Anyway we can go on and on and now the 10Y Treasury is yielding over 25 bp over 3% and heading higher. Housing bubbles are cracking in many parts of the world - India, Australia, Canada, Hong Kong, New York, Denver and many other locations are starting to breakdown from this incessant building of homes and apartments (flats as they are known abroad)You can only blow a bubble so big before it eventually explodes.. And the Fed and the world are all addicted to bubbles. We have huge issues with pensions all around the world - debt to GDP ratios at extremes and student loans, auto loans (with high car payments ever and highest number of payback years). Credit card debt at extremes and everyone is loaded with debt - this is unsustainable. The Indian banking system which was flush with loose money and corrupt insiders is now unraveling at a rapid pace and the INR is dropping to record lows while the markets are finally coming down. We think there may be a reset - do not know when and how - but something has to give because we have gone past the limits of what makes sense. It would have been better if the central banks had a good plan and approach to the crisis and managed it in a much slower and better fashion - but that is not what happened - they turned on the tap at full speed and now what we are experiencing is the overflow effects with no control left. It is like unleashing a monster.. If they would have taken a slow and gradual approach we would not be where we are today - staring down another bubble.. Unfortunately we want quick fixes and have been addicted to these bubble methods - which in the end always lead to busts.. This bust will last longer then anytime before and it will not be pretty. Just wanted to pen down our thoughts this week.We would sell the stocks like BABA - broken down and many tech stocks are finally breaking the 200d SMAs (some have already done so and have gone down since - look at MCHP and now we expect the same for TXN and BIDU etc.) So buy and hold works great when everything moves up in tandem but fails when things go sideways and/or start to breakdown.. We will update more next week. We are recommending short on ETSY and ROKU.

There is some exciting news coming from our site/platform - keep tuned..Good luck trading.

Founder Trucharts.com/Co-founder JETSTOX.com

Labels:

AAPL,

ALGN,

ALibaba stock,

articles to read,

Awesome Market and Stocks to watch,

BABA,

BIDU,

Buy and Sell strategies/techniques,

ETSY,

MCHP,

NOW,

NVDA stock,

ROKU stock,

semi stocks,

TXN

August 26, 2018

Do we keep buying or sell here..

Trucharts Blog 8/24/2018

Do we keep buying or sell here...

Such a conundrum buy or sell. Stocks keep moving up on the Nasdaq - this is very reminiscent of the 2000 bubble - the Dow Jones moved up first, stagnated and then the NASDAQ took over. We are seeing so much froth - in all stocks and at prices that are exhibiting absolute bubble characteristics. But yet stocks keep moving up - and we believe this may be driven by FOMO and central banks seeing the US economy as strong and buying stocks - think about that central banks buying stocks. Never has that happened in the history and ever since central banks have been in existence - money printing has become the norm and no longer an exception. Risk metrics are being thrown out the window and the predictions are getting frothier each day as if there will be no event that will kill this bull market. Valuations for all metrics are at the highest ever and yet there is not a sign of even a single bear on TV. Just run a check on price to book and price to sales along with PE screeners and you will see what we see as the most frothiest market ever. Every deal is getting funded and VCs are raising funds at an unprecedented levels. Everyone is an investing genius when all assets are moving up.. Very typical behavior at the top of bull markets.. You can never call a top until all leading stocks start breaking down.

Anyway - that was a short treatise on our thoughts as to where we are in this stage of the longest bull market in history. We are witnessing one of the biggest bubbles - and we do not know when or how this will end. In this market a $10B market capitalization is considered to be very low. Companies like VEEV, NOW, ALGN, and many others have revenues of no more than $2.2B but their market caps exceed over $78B - total annual revenue for these companies - $4.7B - so the multiple is - 16.59 - so for every dollar in revenue - people are willing to pay $16.59 - hmm - and the Fed says there is no bubble or folks come on TV and say - it is all great - bubbles are made this way..

On another note - marijuana stocks CGC and TLRY are trading at P/S of over 150 - so people are paying $150 per ever $1 of revenue - TOTAL MADNESS.

But these thoughts aside, we know this is an excellent market for trading and making money on a short term basis and also by the use of options or intra day or even from day to day trading. We are seeing machines doing a lot of the trading based on very elemental trading signals and this tells us that fundamentals do not matter - no matter what anyone is saying - there is froth, technical trading and money is being made at a frantic pace..

Using options or put spreads for stocks that are moving sideways or are in an uptrend is a very good way to generate income on your portfolio - candidates for these type of spreads would be CAT, DE, EA, IBM, ATVI, MNST, QCOM, INTC.

No charts this week but checkout some new features on our site like our dynamic screener at with multiple options for screening:

http://www.trucharts.com/drpScanner.aspx

Our single variable scanner at:

http://trucharts.com/Scanner.aspx

We are planning to go long BIDU, EA, QCOM and INTC. We are heading into the AAPL announcement in September so you can be long stocks supplying to AAPL - like IDTI, INTC and others.

Good luck trading - check out our buy/sell signals on our page http://trucharts.com/Stockcharts.aspx

Subscribe and get access to all our features along with notifications..

Good luck trading.

Trucharts Founder

Do we keep buying or sell here...

Such a conundrum buy or sell. Stocks keep moving up on the Nasdaq - this is very reminiscent of the 2000 bubble - the Dow Jones moved up first, stagnated and then the NASDAQ took over. We are seeing so much froth - in all stocks and at prices that are exhibiting absolute bubble characteristics. But yet stocks keep moving up - and we believe this may be driven by FOMO and central banks seeing the US economy as strong and buying stocks - think about that central banks buying stocks. Never has that happened in the history and ever since central banks have been in existence - money printing has become the norm and no longer an exception. Risk metrics are being thrown out the window and the predictions are getting frothier each day as if there will be no event that will kill this bull market. Valuations for all metrics are at the highest ever and yet there is not a sign of even a single bear on TV. Just run a check on price to book and price to sales along with PE screeners and you will see what we see as the most frothiest market ever. Every deal is getting funded and VCs are raising funds at an unprecedented levels. Everyone is an investing genius when all assets are moving up.. Very typical behavior at the top of bull markets.. You can never call a top until all leading stocks start breaking down.

Anyway - that was a short treatise on our thoughts as to where we are in this stage of the longest bull market in history. We are witnessing one of the biggest bubbles - and we do not know when or how this will end. In this market a $10B market capitalization is considered to be very low. Companies like VEEV, NOW, ALGN, and many others have revenues of no more than $2.2B but their market caps exceed over $78B - total annual revenue for these companies - $4.7B - so the multiple is - 16.59 - so for every dollar in revenue - people are willing to pay $16.59 - hmm - and the Fed says there is no bubble or folks come on TV and say - it is all great - bubbles are made this way..

On another note - marijuana stocks CGC and TLRY are trading at P/S of over 150 - so people are paying $150 per ever $1 of revenue - TOTAL MADNESS.

But these thoughts aside, we know this is an excellent market for trading and making money on a short term basis and also by the use of options or intra day or even from day to day trading. We are seeing machines doing a lot of the trading based on very elemental trading signals and this tells us that fundamentals do not matter - no matter what anyone is saying - there is froth, technical trading and money is being made at a frantic pace..

Using options or put spreads for stocks that are moving sideways or are in an uptrend is a very good way to generate income on your portfolio - candidates for these type of spreads would be CAT, DE, EA, IBM, ATVI, MNST, QCOM, INTC.

No charts this week but checkout some new features on our site like our dynamic screener at with multiple options for screening:

http://www.trucharts.com/drpScanner.aspx

Our single variable scanner at:

http://trucharts.com/Scanner.aspx

We are planning to go long BIDU, EA, QCOM and INTC. We are heading into the AAPL announcement in September so you can be long stocks supplying to AAPL - like IDTI, INTC and others.

Good luck trading - check out our buy/sell signals on our page http://trucharts.com/Stockcharts.aspx

Subscribe and get access to all our features along with notifications..

Good luck trading.

Trucharts Founder

July 22, 2018

Our thoughts on the Tech Bubble and the everything bubble

The EVERYTHING Bubble:

It has been a long time since we published our last post. We have had a huge Trump rally since the election and the markets ramped in straight line. The FANG stocks have been the biggest contributors to the gain in the S&P along with the small cap indices hitting new highs.

Stocks like ALGN, NOW along with many others are trading at valuations that defy even the loftiest imaginations. ALGN is trading at a PS ratio of 18.8 (that is we are paying 18x times for every dollar in revenue - absolutely mind boggling numbers). In addition, there is no shortage of companies being funded by VCs at valuations that put the 2000 bubble to shame. Just recently DoorDash received a funding of 535M - that is over HALF A BILLION DOLLARS for a company that delivers food from restaurants.

Think about it - $535 M!! These mind boggling numbers are all a result of the non stop money printing from the Central Banks - the Fed, BOJ, ECB and the PBOC along with many other central banks. This is reminiscent of the 2000 bubble but above and beyond that. Real Estate is in another bubble - and everyone thinks that this will never stop or prices will never move lower. We all know that is not possible - there are limits to everything - simple motto - nothing goes up forever and nothing goes down forever.

Stocks like ALGN, NOW along with many others are trading at valuations that defy even the loftiest imaginations. ALGN is trading at a PS ratio of 18.8 (that is we are paying 18x times for every dollar in revenue - absolutely mind boggling numbers). In addition, there is no shortage of companies being funded by VCs at valuations that put the 2000 bubble to shame. Just recently DoorDash received a funding of 535M - that is over HALF A BILLION DOLLARS for a company that delivers food from restaurants.

Think about it - $535 M!! These mind boggling numbers are all a result of the non stop money printing from the Central Banks - the Fed, BOJ, ECB and the PBOC along with many other central banks. This is reminiscent of the 2000 bubble but above and beyond that. Real Estate is in another bubble - and everyone thinks that this will never stop or prices will never move lower. We all know that is not possible - there are limits to everything - simple motto - nothing goes up forever and nothing goes down forever.

Many of the DOW stocks are in downtrends - check stocks like CAT, DE - http://www.trucharts.com/stockcharts.aspx?tick=CAT

http://www.trucharts.com/stockcharts.aspx?tick=DE

The DOW is being held up by stocks like AAPL, UNH, BA and MSFT. Jeff Bezos has now become the richest person on earth - in a span of 2 years is net worth has moved over 100B - Bill Gates is not even close - think about it - one guy's net worth has crossed over 150B!!! Just in a span of less than 4 years. And yet the TV bobble heads are mesmerized by all of this - not a single talking head wants to say it is a bubble - SNB (Swiss National Bank - yes a bank) along with BOJ are buying stocks - when did banks start buying stocks - unheard of - yet folks it is happening.. Just take a look at some of the exponential charts we had exhibited in our last article and many of these stocks have been moving sideways but still at lofty levels. NVDA still trading at 13 times sales.. No revenue growth in many companies - yet the stocks keep trading at these lofty levels - that is called a BUBBLE.

We have central banks that are enamored by bubbles and bubble behavior - it is like being drunk and high - that feeling lasts only so long. Then we will get to the hangover. Stock buybacks are shrinking the pool of shares available and thereby help companies do financial engineering to goose up their EPS. But this is now a trading market and no longer a investing market - we strongly suggest keeping tight stops at the 100d SMA or 10% below the 50d SMA. Try to take some profits and have at least 30% in cash ready to invest. This has been a crazy market and it is now time to take some money off the table and wait for everything to unfold. We still like gold as a hedge - it has been moving in a tight range between 1200 and 1350 - we would nibble into gold and invest 15%-20% of investable assets.

SP500 has been moving sideways in a consolidation pattern and we have to wait and see what happens in terms of a breakout or breakdown. But is very tradeable - specially ETFs like SPY and SSO, along with the QQQ'. Rates will be going higher, so bonds should be moving down. Sell NFLX and look to short the semiconductors ETF SMH. The FANG stocks - are racing to the TRILLION dollar market cap - just think the FANG stocks are worth over $4.1T!!!

We will all be witnessing history here.. Keep your eyes and ears open.. but always learn when it is time to say - yes I have made a very good return and now it is time to take it to the bank..

Check out our site - our screener is excellent and also do subscribe - checkout our pages - we offer features above and beyond other sites:

http://www.trucharts.com/stockcharts.aspx

Subscribe

Dynamic Screener

Good luck trading..

Founder/CEO (trucharts.com) - Co-Founder (Jetstox.com)

http://www.trucharts.com/stockcharts.aspx?tick=DE

The DOW is being held up by stocks like AAPL, UNH, BA and MSFT. Jeff Bezos has now become the richest person on earth - in a span of 2 years is net worth has moved over 100B - Bill Gates is not even close - think about it - one guy's net worth has crossed over 150B!!! Just in a span of less than 4 years. And yet the TV bobble heads are mesmerized by all of this - not a single talking head wants to say it is a bubble - SNB (Swiss National Bank - yes a bank) along with BOJ are buying stocks - when did banks start buying stocks - unheard of - yet folks it is happening.. Just take a look at some of the exponential charts we had exhibited in our last article and many of these stocks have been moving sideways but still at lofty levels. NVDA still trading at 13 times sales.. No revenue growth in many companies - yet the stocks keep trading at these lofty levels - that is called a BUBBLE.

We have central banks that are enamored by bubbles and bubble behavior - it is like being drunk and high - that feeling lasts only so long. Then we will get to the hangover. Stock buybacks are shrinking the pool of shares available and thereby help companies do financial engineering to goose up their EPS. But this is now a trading market and no longer a investing market - we strongly suggest keeping tight stops at the 100d SMA or 10% below the 50d SMA. Try to take some profits and have at least 30% in cash ready to invest. This has been a crazy market and it is now time to take some money off the table and wait for everything to unfold. We still like gold as a hedge - it has been moving in a tight range between 1200 and 1350 - we would nibble into gold and invest 15%-20% of investable assets.

SP500 has been moving sideways in a consolidation pattern and we have to wait and see what happens in terms of a breakout or breakdown. But is very tradeable - specially ETFs like SPY and SSO, along with the QQQ'. Rates will be going higher, so bonds should be moving down. Sell NFLX and look to short the semiconductors ETF SMH. The FANG stocks - are racing to the TRILLION dollar market cap - just think the FANG stocks are worth over $4.1T!!!

We will all be witnessing history here.. Keep your eyes and ears open.. but always learn when it is time to say - yes I have made a very good return and now it is time to take it to the bank..

Check out our site - our screener is excellent and also do subscribe - checkout our pages - we offer features above and beyond other sites:

http://www.trucharts.com/stockcharts.aspx

Subscribe

Dynamic Screener

Good luck trading..

Founder/CEO (trucharts.com) - Co-Founder (Jetstox.com)

Labels:

ALGN,

bubbles,

charts,

consumer debt,

DIA. Debt to GDP,

Fed,

Fed bubbles,

LRCX,

MACD,

margin debt,

NVDA chart,

Stock Charts Free,

Stocks Blog,

Tech bubble,

Technical Analysis,

trading strategies

November 12, 2017

Kink in the market's armor - Is the pullback coming from these lofty levels??

Kink in the market's armor - Is the pullback coming from these lofty levels??

Are we starting to see a kink the market's armor. Was the 1 year anniversary of the election a mark of a short term or a long term top? What should we expect going into the end of the year and heading into 2018?

Exponential moves in many stocks as been very characteristic of this move in the markets. There has been narrow leadership and everyone, just like in the year 1999-2000, has been loading up in tech stocks and tech stock funds. It seems like we never learn from previous bubble manias and even though we are truly in a bubble with stocks trading at valuations not seen since 2000 and even the market multiples for many metrics above and beyond 1929, 2000 and 2007, none of the analysts (who by the way are in no way responsible for their recommendations) are NOT telling their clients to take profits and wait for better prices. Short covering has also extended many of the popular stocks and obviously the FAANG stocks along with some others in the market - keep flying high. Financial engineering, stock buybacks and earnings manipulations have become a way of keeping prices elevated. The level of complacency is unbelievably striking - there is no respect for risk.

Every person you speak to thinks that there will never be a financial crisis or a major pullback in the markets. Personally, I believe in simple math and that there is always a reversion to the mean and trust me the mean is way below where the markets are. Typically 50d, 100d and 200d SMA are very critical in determining where the markets should find as support levels. Bubbles in real estate (many house flipping shows on TV - similar to 2007), bond bubble (scares the shit out of me) and along with the stock bubble is mind numbing. The funding of startups day in, day out, is also a stark reminder of the days of 1999-2000. Startups that will vaporize and end in total losses will be the norm soon.

Everyone thinks they are an investing genius and there is no way they will lose - that is when you have to take a contrarian view of the markets. Folks willing to fund companies like SLACK (nothing unique), WeWork, and many others at valuations that make your head spin has become norm and every next investor is trying to better up the next one by showing who is boss. This is NOT normal.

The Fed and central banks around the world will be responsible for the next pullback and it will not be pretty. Market capitalizations of many companies are at mind boggling levels and unheard of. Some market capitalizations dwarf GDPs of certain countries and yet everyone thinks we are going higher. We think it is a serious time to start looking into taking profits and buying some protection in certain high flying stocks and sectors (semiconductor being at the top of the list).

We suggest looking at puts for Jan 2019 for stocks like ALGN, ISRG and some other high flying stocks like RACE, NVDA and many others. Keep an eye on HYG and JNK - these are he ETFs related to the high yielding and junk bonds - these are pulling back and have a very good correlation coefficient to the market indices.

Consumer debt is at all time highs - credit card debt is now at over $1T - yes that is a T.... Car loans, housing debt and HELOCS, student loans are at all time highs. We are a world in debt and it is all going to end badly.

Debt/GDP ratios for China is at a staggering 280% and going higher - and other nations debt/gdp ratios are also at staggering highs - all this debt has been created in one decade. The central banks have managed to print so much money that it dwarfs everything we have printed in over 100 years - they have managed to do it in 10 years - that tells you why we are in a bubble. Japan markets are being driven higher because the government is buying stocks - can you believe that - government buying stocks!!! it is the quintessential final nail in the coffin or basically giving up on the basic equations of economics - normal market cycles and following simple rules of the law of numbers and laws of supply/demand and demographics.

Charts for: DIA, LRCX, ALGN and NVDA below: EXPONENTIAL MOVES NEVER END NICELY. We recommend taking profits aggressively.

Here some article links for your reading:

Yearly subscription is only $180 and you can also get access to our automated trading algorithms and if you enter your portfolio - you will get portfolio emails at end of day indicating the technical picture of your stocks and whether these are buy, hold or sell. Only for paying subscribers.

Good luck trading.

CEO/Founder - Trucharts.com

Labels:

ALGN,

bubbles,

charts,

consumer debt,

DIA. Debt to GDP,

Fed,

Fed bubbles,

LRCX,

MACD,

NVDA chart,

Stock Charts Free,

Stocks Blog,

Tech bubble,

Technical Analysis,

trading strategies

Subscribe to:

Posts (Atom)