In this video we discuss overall markets update, NASDAQ and why we had traded AMD stock and made over 40%. We also discuss AAPL, FB, MTCH, CAT, DE, PINS,JPM, casino stocks and why and how critical support prices are used using moving averages. We also show how to use "gap ups" in the screener to find stocks that are poised to move higher and why volume is an important characteristic. We show which stocks we are going to buy next week and how you could have made a very good return if you had traded AMD as we had picked it. So please do subscribe to our youtube channel and also to our site - you could have paid for the site subscription many times over just with the profits from AMD. Good luck trading and leave us your comments, questions or email us. Follow us on twitter @trucharts.

Showing posts with label Fed. Show all posts

Showing posts with label Fed. Show all posts

August 1, 2020

Markets update for week of Jul 27 - Jul 31 and picks for next week..

Labels:

AAPL,

AMD,

Awesome Market and Stocks to watch,

Bull market,

CAT,

Charting,

Covered Calls,

DE,

FB,

Fed,

Fed bubbles,

Fed Fund rates,

Free Stock Charts,

MACD chart,

NASDAQ,

NASDAQ stocks,

OKTA

July 12, 2020

Trucharts.com markets update Jul 12 and stocks to buy for next week. ROKU...

March 7, 2020

Volatility and Markets the corona virus effect

Volatility and Markets the corona virus effect

Well what a couple of weeks its been in the markets - the volatility and point moves have been pretty staggering and unseen in the most recent times and not really since the 1999-2000 bubble and also since the GFC of 2008..all from the corona virus.. Point moves in the DOW, S&P500 along with the NASDAQ are quite a wake up call for many used to the markets that have gone up in a straight line since 2019. And yet no one was crying out that markets were in bubble territory from all valuations perspective and higher than the 1999-2000 bubble.. Yet all the analysts kept raising their target prices for already over hyped and over valued stocks. Well the virus came and fixed that - in a span of 4 or 5 trading days all the gains of 4 months were wiped out. Just check the chart below...

The market players and individual investors had become numb to any down moves and were high on everything moving up and were hypnotized by the markets - since every buying the dip was a good move - specially in the big names - the DOW stocks and the most owned stocks by the entire universe of funds - HD, MSFT, FB, GOOG, and you can easily name the whole list..

As you can see the markets look oversold and may have some consolidation at this level - around 25000 for the DOW and around 280 for the S&P500. The QQQ (or NASDAQ even though looking oversold - may head lower - we think there is short term risk to stocks like AAPL, MSFT, AMZN and FB - the big movers for the past few months. AAPL definitely moves lower to around 240.. We recommend taking some profits in these big names.

Here are the charts for AAPL, AMZN, FB and MSFT.

FB looks the weakest...

The DIA chart here is showing resistance at 270 so we should expect a bounce to that level (around 27000 for the DOW).

The DIA chart here is showing resistance at 270 so we should expect a bounce to that level (around 27000 for the DOW).

Although the markets have been volatile - it is a great time to make money.. The volatility creates huge opportunities to make money with intraday or overnight trades with the right stocks. Many stocks are moving over $10+ a day and that is a huge bonus to make money. It is easy to find these stocks and these are very standard big names like AMZN, MA, V, SHOP, ADBE, NFLX and many more. We recommend more day trading rather than holding overnight positions.

We really like gold and you can check our tweets and blogs and our call on gold since it has been at 1100 and now has had a move to around 1700 a move of around 40%+.. We still like gold and are long physical bullion and buying more... Our target is 2500 as fiat currencies are failing and in the end there will be some reset as the debts are unsustainable as are the promises being made by governments. We expect INR (Indian rupee to head to 80 per dollar..)

Good luck trading and do subscribe to our site - it is a measly 180 per year (premium) and 95/year for basic membership to excellent REAL TIME CHARTS, QUOTES, FUNDAMENTAL DATA, excellent scanner (screener) along with buy/sell strategy signals - we are working on sending technical alerts via sms/email...and many other features...

Sincerely

Bob B (Founder Trucharts.com)

Labels:

AAPL,

AMZN,

corona virus,

FB,

Fed,

Markets,

msft,

QQQ,

SP500 chart,

stocks and DOW Jones,

volatility

January 6, 2019

Schizophrenic markets, Fed Reserve, Powell and markets moving up, FAANG stocks

Schizophrenic markets, Fed Reserve, Powell and markets moving up, FAANG stocks

Well the man with balls - lost them over Xmas and New Year's eve - you know who we are talking about - none other than good old Powell himself.. I guess he had a good chat with grandma Yellen and good old bubble maker Bernanke himself and suddenly had his balls chopped off for being too aggressive and making the rich poor - oh we feel for the rich!!! What a fucking joke. Markets gyrating 1000 points in a day, 700 points - guess we have to get used to these type of moves. And then we have the blabber heads on TV trying to explain these markets. And non stop talk about the Fed and their constant analysis - just annoying - it would be nice to have a channel where no one says anything. Yet have you heard anyone yet mentioning that the bubble is falling apart. Somehow the Fed roll off the balance sheet is now being questioned after the teachers of Powell (Yellen/Bernanke) made some noise on Friday and everyone was excited. Again we are coming off very oversold conditions and several stocks are bouncing of key moving averages. We like any stock here for the short term - normally all stocks in the indices will move with the move up. so the FAANG stocks are also good for the ride up. Banking stocks look strong on charts - again be mindful - we are talking about some short term moves here and these can be used to trade intra-day and for overnight positions. Obvious names come to mind - FB, GOOG, SHOP, GRUB, NFLX (which moved up and we think it is going to 300). There are many other heavily shorted stocks that also have high betas.

Here is an article worth reading:

https://www.zerohedge.com/news/2019-01-06/ugly-truth-you-wont-hear-fed

The AAPL news was expected - it was obvious based on the suppliers indicating that their biggest customer (as if this was a big secret) was canceling orders - so the news from AAPL should not have shocked anyone and it was also obvious when the stock started falling after the last earnings report. As expected the stocks dropped and the once darling of Wall Street lost a total of over 350B in market cap value - that is the whole market cap for FB - and we say the markets are not over-valued or expensive - this is actually happening - everyone is in equities and the ETFs do not help - we think ETFs should be banned - these distort markets and are really another way for Wall St to just make more money. How are these different from mutual funds - there is really no difference.

AAPL will need to change its approach on the next generation phones and there is nothing new on the horizon and specially this paying $1000 for a phone days are over. These companies need to start realizing that after a certain point - (same as computers) - people are not going to pay up for small feature improvements and there is a lot of competition in this space. Competitive phones are cheaper and better. A good phone should be no more than 500 - yet all these companies keep pricing themselves out of the markets. As you can see Samsung and AAPL are losing market share to Chinese competitors all around the world and we expect that prices will trend downwards as we may have reached the peak with IPHONE X.

There will be backlash as ordinary customers will stop paying these high prices being pushed onto them. This is going to be the next computer - lots of competition and prices will start to come down. There is a lot of buzz around 5G - we expect some noise around this - but it will be short lived. Prices will not be going any higher from here on forward. This means it will impact margins not just for AAPL, Samsung and others - but also their downline suppliers - they will be put under pressure on component pricing.

We would trade the markets here as earnings season is upon us - watch the man without the balls now - Powell - who changes his tune every couple of weeks. He is like a management trainee..

We are expecting to launch our new revamped site with new features and buy/sell directly from our site towards the end of Jan - slight delay to our original planned date.

Time to go and make some money.. Good luck trading.

HAPPY NEW YEAR 2019..

Trucharts team/Founder (Co-founder Jetstox.com)

Here is an article worth reading:

https://www.zerohedge.com/news/2019-01-06/ugly-truth-you-wont-hear-fed

The AAPL news was expected - it was obvious based on the suppliers indicating that their biggest customer (as if this was a big secret) was canceling orders - so the news from AAPL should not have shocked anyone and it was also obvious when the stock started falling after the last earnings report. As expected the stocks dropped and the once darling of Wall Street lost a total of over 350B in market cap value - that is the whole market cap for FB - and we say the markets are not over-valued or expensive - this is actually happening - everyone is in equities and the ETFs do not help - we think ETFs should be banned - these distort markets and are really another way for Wall St to just make more money. How are these different from mutual funds - there is really no difference.

AAPL will need to change its approach on the next generation phones and there is nothing new on the horizon and specially this paying $1000 for a phone days are over. These companies need to start realizing that after a certain point - (same as computers) - people are not going to pay up for small feature improvements and there is a lot of competition in this space. Competitive phones are cheaper and better. A good phone should be no more than 500 - yet all these companies keep pricing themselves out of the markets. As you can see Samsung and AAPL are losing market share to Chinese competitors all around the world and we expect that prices will trend downwards as we may have reached the peak with IPHONE X.

There will be backlash as ordinary customers will stop paying these high prices being pushed onto them. This is going to be the next computer - lots of competition and prices will start to come down. There is a lot of buzz around 5G - we expect some noise around this - but it will be short lived. Prices will not be going any higher from here on forward. This means it will impact margins not just for AAPL, Samsung and others - but also their downline suppliers - they will be put under pressure on component pricing.

We would trade the markets here as earnings season is upon us - watch the man without the balls now - Powell - who changes his tune every couple of weeks. He is like a management trainee..

We are expecting to launch our new revamped site with new features and buy/sell directly from our site towards the end of Jan - slight delay to our original planned date.

Time to go and make some money.. Good luck trading.

HAPPY NEW YEAR 2019..

Trucharts team/Founder (Co-founder Jetstox.com)

Labels:

AAPL,

ADBE Service Now - NOW Stock,

ALGN,

ALibaba stock,

AMZN,

BABA,

Blog,

FB,

Fed,

Fed bubbles,

Fed in a corner,

Free Stock Charts,

HD - Home depot,

NFLX,

NVDA,

NVDA chart,

Options Strategy

July 22, 2018

Our thoughts on the Tech Bubble and the everything bubble

The EVERYTHING Bubble:

It has been a long time since we published our last post. We have had a huge Trump rally since the election and the markets ramped in straight line. The FANG stocks have been the biggest contributors to the gain in the S&P along with the small cap indices hitting new highs.

Stocks like ALGN, NOW along with many others are trading at valuations that defy even the loftiest imaginations. ALGN is trading at a PS ratio of 18.8 (that is we are paying 18x times for every dollar in revenue - absolutely mind boggling numbers). In addition, there is no shortage of companies being funded by VCs at valuations that put the 2000 bubble to shame. Just recently DoorDash received a funding of 535M - that is over HALF A BILLION DOLLARS for a company that delivers food from restaurants.

Think about it - $535 M!! These mind boggling numbers are all a result of the non stop money printing from the Central Banks - the Fed, BOJ, ECB and the PBOC along with many other central banks. This is reminiscent of the 2000 bubble but above and beyond that. Real Estate is in another bubble - and everyone thinks that this will never stop or prices will never move lower. We all know that is not possible - there are limits to everything - simple motto - nothing goes up forever and nothing goes down forever.

Stocks like ALGN, NOW along with many others are trading at valuations that defy even the loftiest imaginations. ALGN is trading at a PS ratio of 18.8 (that is we are paying 18x times for every dollar in revenue - absolutely mind boggling numbers). In addition, there is no shortage of companies being funded by VCs at valuations that put the 2000 bubble to shame. Just recently DoorDash received a funding of 535M - that is over HALF A BILLION DOLLARS for a company that delivers food from restaurants.

Think about it - $535 M!! These mind boggling numbers are all a result of the non stop money printing from the Central Banks - the Fed, BOJ, ECB and the PBOC along with many other central banks. This is reminiscent of the 2000 bubble but above and beyond that. Real Estate is in another bubble - and everyone thinks that this will never stop or prices will never move lower. We all know that is not possible - there are limits to everything - simple motto - nothing goes up forever and nothing goes down forever.

Many of the DOW stocks are in downtrends - check stocks like CAT, DE - http://www.trucharts.com/stockcharts.aspx?tick=CAT

http://www.trucharts.com/stockcharts.aspx?tick=DE

The DOW is being held up by stocks like AAPL, UNH, BA and MSFT. Jeff Bezos has now become the richest person on earth - in a span of 2 years is net worth has moved over 100B - Bill Gates is not even close - think about it - one guy's net worth has crossed over 150B!!! Just in a span of less than 4 years. And yet the TV bobble heads are mesmerized by all of this - not a single talking head wants to say it is a bubble - SNB (Swiss National Bank - yes a bank) along with BOJ are buying stocks - when did banks start buying stocks - unheard of - yet folks it is happening.. Just take a look at some of the exponential charts we had exhibited in our last article and many of these stocks have been moving sideways but still at lofty levels. NVDA still trading at 13 times sales.. No revenue growth in many companies - yet the stocks keep trading at these lofty levels - that is called a BUBBLE.

We have central banks that are enamored by bubbles and bubble behavior - it is like being drunk and high - that feeling lasts only so long. Then we will get to the hangover. Stock buybacks are shrinking the pool of shares available and thereby help companies do financial engineering to goose up their EPS. But this is now a trading market and no longer a investing market - we strongly suggest keeping tight stops at the 100d SMA or 10% below the 50d SMA. Try to take some profits and have at least 30% in cash ready to invest. This has been a crazy market and it is now time to take some money off the table and wait for everything to unfold. We still like gold as a hedge - it has been moving in a tight range between 1200 and 1350 - we would nibble into gold and invest 15%-20% of investable assets.

SP500 has been moving sideways in a consolidation pattern and we have to wait and see what happens in terms of a breakout or breakdown. But is very tradeable - specially ETFs like SPY and SSO, along with the QQQ'. Rates will be going higher, so bonds should be moving down. Sell NFLX and look to short the semiconductors ETF SMH. The FANG stocks - are racing to the TRILLION dollar market cap - just think the FANG stocks are worth over $4.1T!!!

We will all be witnessing history here.. Keep your eyes and ears open.. but always learn when it is time to say - yes I have made a very good return and now it is time to take it to the bank..

Check out our site - our screener is excellent and also do subscribe - checkout our pages - we offer features above and beyond other sites:

http://www.trucharts.com/stockcharts.aspx

Subscribe

Dynamic Screener

Good luck trading..

Founder/CEO (trucharts.com) - Co-Founder (Jetstox.com)

http://www.trucharts.com/stockcharts.aspx?tick=DE

The DOW is being held up by stocks like AAPL, UNH, BA and MSFT. Jeff Bezos has now become the richest person on earth - in a span of 2 years is net worth has moved over 100B - Bill Gates is not even close - think about it - one guy's net worth has crossed over 150B!!! Just in a span of less than 4 years. And yet the TV bobble heads are mesmerized by all of this - not a single talking head wants to say it is a bubble - SNB (Swiss National Bank - yes a bank) along with BOJ are buying stocks - when did banks start buying stocks - unheard of - yet folks it is happening.. Just take a look at some of the exponential charts we had exhibited in our last article and many of these stocks have been moving sideways but still at lofty levels. NVDA still trading at 13 times sales.. No revenue growth in many companies - yet the stocks keep trading at these lofty levels - that is called a BUBBLE.

We have central banks that are enamored by bubbles and bubble behavior - it is like being drunk and high - that feeling lasts only so long. Then we will get to the hangover. Stock buybacks are shrinking the pool of shares available and thereby help companies do financial engineering to goose up their EPS. But this is now a trading market and no longer a investing market - we strongly suggest keeping tight stops at the 100d SMA or 10% below the 50d SMA. Try to take some profits and have at least 30% in cash ready to invest. This has been a crazy market and it is now time to take some money off the table and wait for everything to unfold. We still like gold as a hedge - it has been moving in a tight range between 1200 and 1350 - we would nibble into gold and invest 15%-20% of investable assets.

SP500 has been moving sideways in a consolidation pattern and we have to wait and see what happens in terms of a breakout or breakdown. But is very tradeable - specially ETFs like SPY and SSO, along with the QQQ'. Rates will be going higher, so bonds should be moving down. Sell NFLX and look to short the semiconductors ETF SMH. The FANG stocks - are racing to the TRILLION dollar market cap - just think the FANG stocks are worth over $4.1T!!!

We will all be witnessing history here.. Keep your eyes and ears open.. but always learn when it is time to say - yes I have made a very good return and now it is time to take it to the bank..

Check out our site - our screener is excellent and also do subscribe - checkout our pages - we offer features above and beyond other sites:

http://www.trucharts.com/stockcharts.aspx

Subscribe

Dynamic Screener

Good luck trading..

Founder/CEO (trucharts.com) - Co-Founder (Jetstox.com)

Labels:

ALGN,

bubbles,

charts,

consumer debt,

DIA. Debt to GDP,

Fed,

Fed bubbles,

LRCX,

MACD,

margin debt,

NVDA chart,

Stock Charts Free,

Stocks Blog,

Tech bubble,

Technical Analysis,

trading strategies

November 12, 2017

Kink in the market's armor - Is the pullback coming from these lofty levels??

Kink in the market's armor - Is the pullback coming from these lofty levels??

Are we starting to see a kink the market's armor. Was the 1 year anniversary of the election a mark of a short term or a long term top? What should we expect going into the end of the year and heading into 2018?

Exponential moves in many stocks as been very characteristic of this move in the markets. There has been narrow leadership and everyone, just like in the year 1999-2000, has been loading up in tech stocks and tech stock funds. It seems like we never learn from previous bubble manias and even though we are truly in a bubble with stocks trading at valuations not seen since 2000 and even the market multiples for many metrics above and beyond 1929, 2000 and 2007, none of the analysts (who by the way are in no way responsible for their recommendations) are NOT telling their clients to take profits and wait for better prices. Short covering has also extended many of the popular stocks and obviously the FAANG stocks along with some others in the market - keep flying high. Financial engineering, stock buybacks and earnings manipulations have become a way of keeping prices elevated. The level of complacency is unbelievably striking - there is no respect for risk.

Every person you speak to thinks that there will never be a financial crisis or a major pullback in the markets. Personally, I believe in simple math and that there is always a reversion to the mean and trust me the mean is way below where the markets are. Typically 50d, 100d and 200d SMA are very critical in determining where the markets should find as support levels. Bubbles in real estate (many house flipping shows on TV - similar to 2007), bond bubble (scares the shit out of me) and along with the stock bubble is mind numbing. The funding of startups day in, day out, is also a stark reminder of the days of 1999-2000. Startups that will vaporize and end in total losses will be the norm soon.

Everyone thinks they are an investing genius and there is no way they will lose - that is when you have to take a contrarian view of the markets. Folks willing to fund companies like SLACK (nothing unique), WeWork, and many others at valuations that make your head spin has become norm and every next investor is trying to better up the next one by showing who is boss. This is NOT normal.

The Fed and central banks around the world will be responsible for the next pullback and it will not be pretty. Market capitalizations of many companies are at mind boggling levels and unheard of. Some market capitalizations dwarf GDPs of certain countries and yet everyone thinks we are going higher. We think it is a serious time to start looking into taking profits and buying some protection in certain high flying stocks and sectors (semiconductor being at the top of the list).

We suggest looking at puts for Jan 2019 for stocks like ALGN, ISRG and some other high flying stocks like RACE, NVDA and many others. Keep an eye on HYG and JNK - these are he ETFs related to the high yielding and junk bonds - these are pulling back and have a very good correlation coefficient to the market indices.

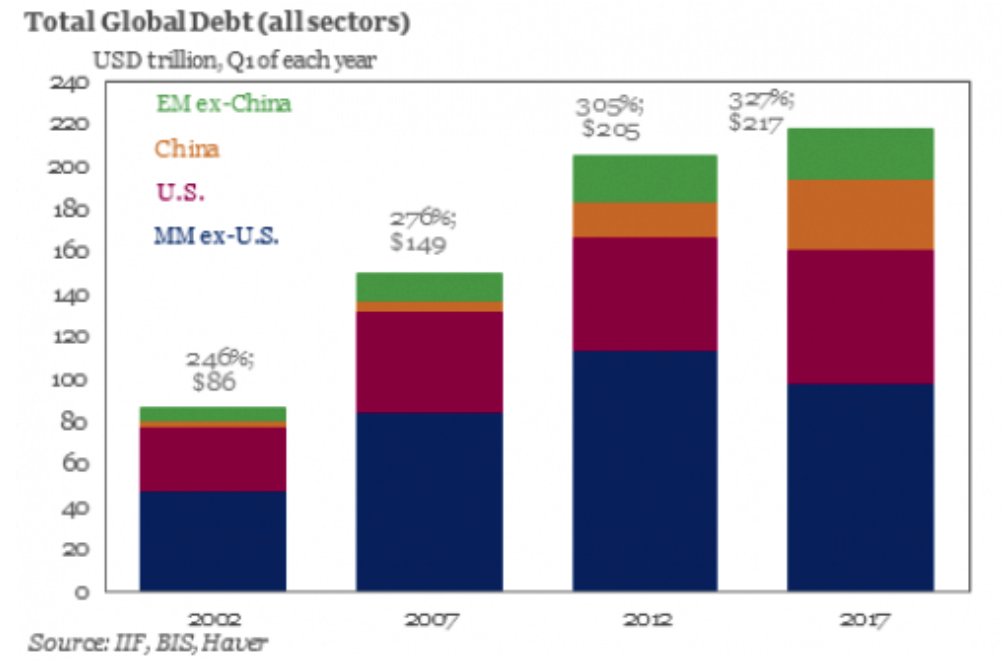

Consumer debt is at all time highs - credit card debt is now at over $1T - yes that is a T.... Car loans, housing debt and HELOCS, student loans are at all time highs. We are a world in debt and it is all going to end badly.

Debt/GDP ratios for China is at a staggering 280% and going higher - and other nations debt/gdp ratios are also at staggering highs - all this debt has been created in one decade. The central banks have managed to print so much money that it dwarfs everything we have printed in over 100 years - they have managed to do it in 10 years - that tells you why we are in a bubble. Japan markets are being driven higher because the government is buying stocks - can you believe that - government buying stocks!!! it is the quintessential final nail in the coffin or basically giving up on the basic equations of economics - normal market cycles and following simple rules of the law of numbers and laws of supply/demand and demographics.

Charts for: DIA, LRCX, ALGN and NVDA below: EXPONENTIAL MOVES NEVER END NICELY. We recommend taking profits aggressively.

Here some article links for your reading:

Yearly subscription is only $180 and you can also get access to our automated trading algorithms and if you enter your portfolio - you will get portfolio emails at end of day indicating the technical picture of your stocks and whether these are buy, hold or sell. Only for paying subscribers.

Good luck trading.

CEO/Founder - Trucharts.com

Labels:

ALGN,

bubbles,

charts,

consumer debt,

DIA. Debt to GDP,

Fed,

Fed bubbles,

LRCX,

MACD,

NVDA chart,

Stock Charts Free,

Stocks Blog,

Tech bubble,

Technical Analysis,

trading strategies

October 19, 2017

Bubbles everywhere and new highs and extreme complacency

Bubbles, Bubbles and more of it...

This is what bubbles of made of - low levels of volatility and no respect for risk. We are now in a massive bubble and it is now looking like it may also beat the 2000 bubble. All around me I see people discussing stocks and trying to make that quick buck and let me tell you in this type of environment it is very easy to do that. Extreme liquidity from all central banks and the Yellen, Draghi put is making this market look even more risky day by day. But right now everyone is high and happy - as every investor thinks that stocks will never ever go down and there is no risk. Stocks like IBM, UNH and big cap names moving over 10% in a day is not a normal market. Stock rebounding on bad news is not a normal market. All news is good news, even if it is manipulated from an earnings perspective. All valuation metrics are above and beyond the previous bubbles and we have literally created money out of thin air. Central bank balance sheets are loaded with debt instruments, company valuations from a Price/Sales and PE ratios are at highs that eclipse the previous bubbles. There is total disregard for risk and yet no one cares - everyone acts like this is normal price action. Take for example IBM - they beat earnings because of their tax rate - and their tax rate - a phenomenal 11% - yes you read that right - a company as big as IBM pays a 11% effective tax rate and us normal folks pay at 30%. Their revenue was marginally higher and yet the stock was up over 10% in a day - think about it IBM up over 10% in a day. ADBE reported numbers that were slightly higher than the analyst estimates for 2018 and the stock jumped over $15 in after hours - yes that is right over 10% move in a single day. Yet we have the TV talking heads all acting like this is normal and there is no bubble. We do, my friends, and I have lived through two of these and this is the 3rd one - but this is not only a stock bubble it is like a loaded gun - completely leveraged - with housing, stocks, debt, and bonds all at all time highs and we are supposed to act like this is normal.

Our good old friend Masayoshi from Japan is back and making the rounds - he lost over 70B in the last bubble - yet people gave him money again and he is running around like a boy in a toy store making stupid investments in companies that will never survive and at valuations that are mind blowing. He has a 100B fund. Think about that 100B to invest anyway he wants with no restrictions. Exactly like 1999-2000.

Everyone is feeling rich and the rich just got a lot more richer. More billionaires everyday - why? - all because the Fed is a puppet to the banks and the markets. Foot on the pedal on money printing. They dare not touch the dial or the button - who knows what will happen if they cease or pull back on their asset purchase programs or take away the punch bowl. They are petrified and have no handle on the situation - they use outdated metrics to measure inflation so that can keep printing more money and to keep juicing the pump.. We are all at a big party and no one thinks it is going to end - end it will - when maybe next year - I think. But until then just keep drinking...and get drunk.

Margin debt is at all time highs and yet no one is worried - the last time that happened was at the market tops of 2000 and 2007.

Some articles to read:

http://www.zerohedge.com/news/2017-10-18/long-list-market-anomalies-what-look-if-indeed-major-bubble

http://www.zerohedge.com/news/2017-10-18/something-wicked-way-comes-mcdonalds-–-bear-bull-costume

http://www.zerohedge.com/news/2017-10-18/when-not-if

http://www.zerohedge.com/news/2017-10-17/bubble-nomics

It is a bubble when you no longer have to flip homes to make money - you just have to take a snap (photo) and send it to an investor and just make money (check SnapFlip). Boy times have changed but the story has not. It is the same - wash, rinse and repeat (just with different names). Every show on TV now is related to housing flips and everyone is in it. Amazing how things look the same once you have experienced it before - what is that called - oh - 'deja-vu'. The more they say it is different this time, the more convinced I am that we are in this huge bubble and something is about to break. When who knows, but it will happen. Just read the articles in the links above.

Margin debt at new highs, consumer credit card debt at new highs, auto loans at new highs, student loans debt at new highs - we are all running on borrowed time - we are a mind boggling debt creation machine and what is that called - enslavement. The rich have gotten richer and they are creating debt to enslave others. Companies are mired in debt and China - don't even talk about the Chinese regime - they are lying about everything - just to keep up the charade - debt is ballooning in China and is at over 250% of GDP and everyone says - that's OK - they will manage - of course, I could manage a trillion dollars as long as I have dollar printing machine in my back yard.

It is amazing to see what is happening and everyone is smiling and acting like - there is no problem - it is all glorious.. Sure it is.. IPOs left and right, mind numbing valuations for startups with no revenue and so many stupid companies being funded - it just rings bells of 1999-2000. I think there must be a 17 year cycle or something..Anyway keep your eyes wide open, and learn to take money off the table and take profits.

We have a very unique feature on our platform - we call it PortfolioSense - as a subscriber you can enter any number of portfolios and we will send you an email at the end of the day to show how your stocks are doing in terms of the technical signals related to the holding in your portfolio. You can then check out the chart to see if you need to make a buy or sell decision. Check it out - I use it all the time and here is the link - http://www.trucharts.com/TransactionDetails.aspx

Don't even get me started on the Drumpf..

Labels:

amba,

amgn,

AMZN,

Charting,

Dow Jones,

Fed,

Free Stock Charts,

NASDAQ,

NVDA,

Stock Market,

Stocks,

yellen

June 27, 2017

Mr. Market, Yellen, Gold, Tech stocks and bubbles

Markets, Yellen, Fed, gold, Tech stocks and bubbles

Well another week and Monday markets were up and all the bulls were running around predicting that the markets were headed higher. Sure enough we had a down week last week and Grandma Yellen's move to tighten is still being partially ignored by the markets. TLT or bonds were moving higher with yields moving down. We like TLT and have been long since 120. Check the chart here:

There was a heavy rotation into the biotech stocks this past week. The move in the biotech ETFs such as XBI, IBB and BIB were excellent and look like weekly breakouts. We expect these to move higher based on their weekly chart patterns. Check these charts below and we would expect a pullback before we would take any long positions.

Weekly charts:

Weekly charts:

We believe the rotation is coming out of tech stocks and moving into alternate investments that have been lagging. There is no question that we are in a bubble mode for all assets - the question is, when will this bubble burst. Over 90% of the tech stocks are trading at ridiculous PEs and valuations (that are above the 2000 stock bubble).

Even with Fed tightening, central banks around the world are still in easing and loose monetary policy mode.

Gold has been bouncing around this level between 1200 - 1330 for quite some time. Technicals are negative and we have to see a decisive break above the weekly moving averages of 13, 50 and 100 to turn bullish. We do not see that happening unless there is a monetary crisis a.k.a China Yuan or some other country currency crashing.

In the tech stocks we like, QCOM and WDC. These stocks relative to their peers are cheap and have good dividends and low PEs. We also like Alibaba - BABA, TWTR (if weekly close above $19.5) and would short NVDA. Please keep tight stops at 5% below 50d SMA or 20 week SMA. You can find these values on our site when you plot the charts on the www.trucharts.com/stockcharts.aspx page.

We have added new features such as customizable multiple screener for various technical signals on our site under "Screener" menu option - check it out.

We have video tours of our site on how to use the site effectively - please do check it out.

We have a discounted subscriber pricing which is at $10 per month or $120 annually. Please check this out on our subscriber page.

Good luck trading.

B. Bhatia

Founder/CEO - Trucharts.com

Even with Fed tightening, central banks around the world are still in easing and loose monetary policy mode.

Gold has been bouncing around this level between 1200 - 1330 for quite some time. Technicals are negative and we have to see a decisive break above the weekly moving averages of 13, 50 and 100 to turn bullish. We do not see that happening unless there is a monetary crisis a.k.a China Yuan or some other country currency crashing.

In the tech stocks we like, QCOM and WDC. These stocks relative to their peers are cheap and have good dividends and low PEs. We also like Alibaba - BABA, TWTR (if weekly close above $19.5) and would short NVDA. Please keep tight stops at 5% below 50d SMA or 20 week SMA. You can find these values on our site when you plot the charts on the www.trucharts.com/stockcharts.aspx page.

We have added new features such as customizable multiple screener for various technical signals on our site under "Screener" menu option - check it out.

We have video tours of our site on how to use the site effectively - please do check it out.

We have a discounted subscriber pricing which is at $10 per month or $120 annually. Please check this out on our subscriber page.

Good luck trading.

B. Bhatia

Founder/CEO - Trucharts.com

Labels:

amgn,

BABA,

BIOTECH,

buy stock,

Fed,

gold,

gold mners,

NVDA,

sp500,

Stock Charts,

Tech stocks,

Technical Analysis,

TWTR,

WDC,

yellen,

youtube

September 27, 2015

NASDAQ,DOW and SPY where are these headed? What to do with your portfolio? Trucharts Weekly Blog

Trucharts Weekly Blog

NASDAQ,DOW and SPY where are these headed? What to do with your portfolio?

Sorry that we were unable to publish our blog last weekend due to some family commitments. Well the Fed speech impact was short lived and then volatility picked up in the past week and the biggest standout was the biotech sector which had driven up the NASDAQ to its 2000 highs and everyone on TV was still bullish on biotech sector. As much as we like some stocks in the drug sector and the biotech sector, the valuations were not justified - in addition, we were seeing heavy insider selling in many companies. Many biotech companies with no revenues were showing exponential charts and if you recall how we warned about exponential charts - these always are a bad sign of things to come. Just check out some of the high flyers in the biotech sector. We were also seeing weakening technical signals in the ETF IBB when it was hitting new highs.

Check these stocks:

www.trucharts.com/stockview.aspx?TICK=ICPT

We also have the chart here for the buy/sell signals for IBB on weekly chart - see below (this feature is provided to our registered/subscribed users). We think IBB is headed to around 260 - 280 range. There will be margin calls on folks who are long biotech stocks.

Now where do we think the markets are headed - gold moved up after Godmother Yellen spoke on Thursday that rates would rise in 2015 and markets were up in on Friday early and then pulled back later in the afternoon. We believe the institutions are moving into the comfort of consumer cyclicals, staples and high divided yielding stocks in sectors that are still strong. We are concerned that we may see dividend cuts in the stocks of oil companies - just a guess - but with oil down - there is no way these companies can sustain such high payouts. In addition, we expect massive layoffs and the oil states economies will be affected (Texas, Louisiana and others). We like NKE after their earnings report. We hav been playing with NFLX and are short FIT/GPRO (valuation too high). We expect the DOW to stay range bound 15000 - 17000 for some time here, SPY is headed to around 1750 - current price is 192.85. We would be very careful here - SPY and DIA have broken 100 week SMA.

China slowdown has now shown up in 2 major equipment suppliers - JOY and CAT. CHina is definitely slowing down and we have to see if they are headed the way of Japan. In addition, the central banks are still running loose with money printing and it seems to be helping the top 1% only. Brazil is going to the dogs with its credit rating cut. The rates for 10 year bonds in Brazil have shot up to 16% - want buy some Brazil debt - anyone? We would stay away from these stocks. We like gold stocks - but we need to see high volume breakout - we are not there yet. We encourage to write covered calls on your positions - that is what we have done and that has protected our portfolio. The trend is down. The ony thing in favor of the indices is the RSI is oversold - but needs to consolidate. Here is weekly chart for SPY:

Check out our site features at the best subscription rates in the industry and on the web:

Good luck trading.

Stay nimble.

Trucharts Team and Founder/CEO

Labels:

AAPL,

amba,

amgn,

biotech short,

Biotech Stocks,

BIS,

Blog,

bubbles,

Buy and Sell strategies/techniques,

Buy/Sell Strategy,

china,

china markets,

Fed,

Free Stock Charts,

Technical Analysis

June 14, 2015

Watch these charts closely this week..

Trucharts.com Blog Week ending 6/12/2015:

Watch these things and charts closely this week..

We did not have a chance to write a complete weekly blog last week due to some family emergencies. Finally got over these and now back to writing and watching and trading the markets this week.

We are sure you must have been noticing the past few weeks how the big market players have been holding the DOW at 18000, SP500 at 2100 and the NASDAQ at 5000 - rigging - you have to wonder. Every week (for the past six weeks), there has been at least one day a week for a positive 3 digit move in the markets and then we have several - what we call - consolidation days - and then we have had news on Greece everyday impacting the moves in the indices. It is becoming like a same story different day.. Still there has been no resolution on the Greece situation, and then we are seeing some news today that the Greeks have not come forth with a solution that pleases the IMF and the Eurozone. Let us see how this unfolds.

Now back to our markets and China - an amazing bubble brewing there in the markets. A billionaire is made everyday and the three drop out due to improper financial conduct by their respective companies - just take a look at Hanergy as an example.

We think the underlying fundamentals are weak and many stocks are exhibiting weak technicals, and in addition, we think the tech stocks are looking weak. We strongly recommend taking profits in this sector.

Here are some charts from our markets we are watching closely this week. Keep an eye on the 13 week SMA, the 50 week SMA and the 100 week SMA. Amazing support levels for all the ETFs below.

Charts Weekly:

Check the chart for:

CVX at critical support - we think this could go to 90.

DIA going to 50 week SMA?

IBB at 13 week SMA - still looking good - still not closing below 13 week SMA.

IWM - Russell 2000 ETF - still strong

MMM - heading to 50 week SMA - should be a good buy point for a bounce

SPY- at week SMA - great support here.

TXN - at 50 week SMA - looking weak - may bounce here

XLK ETF - technology starting to show weakness. (See INTC chart below)

We are long BIDU,CYBR,TWTR,Z, and short AEM,AMBA. Closed DTEA, LLY and UA this week for a good profit.

IPOs to watch this week: Fitbit - Wednesday - FIT.

Critical earnings this week:

Adobe Systems (ADBE), FedEx FDX, Oracle (ORCL), Darden Restaurants (DRI), Kroger (KR), CarMax (KMX), and KB Home (KBH), DTEA on Tuesday.

Check out our special subscription offer - just $90 for the whole year. The best deal of any technical and stock charting website on the web. Here is the link:

http://www.trucharts.com/truCharts_Services.aspx

Check out the results of our backtest feature - the fastest on the web: This is for IBB ETF with a 8 SMA crosses 12 SMA and exit is 11 days after crossover - the short needs to be optimized - but the long strategy shows a 174% return.

Watch these things and charts closely this week..

We did not have a chance to write a complete weekly blog last week due to some family emergencies. Finally got over these and now back to writing and watching and trading the markets this week.

We are sure you must have been noticing the past few weeks how the big market players have been holding the DOW at 18000, SP500 at 2100 and the NASDAQ at 5000 - rigging - you have to wonder. Every week (for the past six weeks), there has been at least one day a week for a positive 3 digit move in the markets and then we have several - what we call - consolidation days - and then we have had news on Greece everyday impacting the moves in the indices. It is becoming like a same story different day.. Still there has been no resolution on the Greece situation, and then we are seeing some news today that the Greeks have not come forth with a solution that pleases the IMF and the Eurozone. Let us see how this unfolds.

Now back to our markets and China - an amazing bubble brewing there in the markets. A billionaire is made everyday and the three drop out due to improper financial conduct by their respective companies - just take a look at Hanergy as an example.

We think the underlying fundamentals are weak and many stocks are exhibiting weak technicals, and in addition, we think the tech stocks are looking weak. We strongly recommend taking profits in this sector.

Here are some charts from our markets we are watching closely this week. Keep an eye on the 13 week SMA, the 50 week SMA and the 100 week SMA. Amazing support levels for all the ETFs below.

Charts Weekly:

Check the chart for:

CVX at critical support - we think this could go to 90.

DIA going to 50 week SMA?

IBB at 13 week SMA - still looking good - still not closing below 13 week SMA.

IWM - Russell 2000 ETF - still strong

MMM - heading to 50 week SMA - should be a good buy point for a bounce

SPY- at week SMA - great support here.

TXN - at 50 week SMA - looking weak - may bounce here

XLK ETF - technology starting to show weakness. (See INTC chart below)

We are long BIDU,CYBR,TWTR,Z, and short AEM,AMBA. Closed DTEA, LLY and UA this week for a good profit.

IPOs to watch this week: Fitbit - Wednesday - FIT.

Critical earnings this week:

Adobe Systems (ADBE), FedEx FDX, Oracle (ORCL), Darden Restaurants (DRI), Kroger (KR), CarMax (KMX), and KB Home (KBH), DTEA on Tuesday.

Check out our special subscription offer - just $90 for the whole year. The best deal of any technical and stock charting website on the web. Here is the link:

http://www.trucharts.com/truCharts_Services.aspx

Check out the results of our backtest feature - the fastest on the web: This is for IBB ETF with a 8 SMA crosses 12 SMA and exit is 11 days after crossover - the short needs to be optimized - but the long strategy shows a 174% return.

May 31, 2015

Markets Direction - Up or Down? Where are we headed? Trucharts.com Blog Update

Markets Direction - Up or Down? Where are we headed? Weekend Blog Update week ending 5/29/15

We have not had a chance to do a weekend update due to the jet lag from travel and other pressing matters. Finally getting some time to put my thoughts down related to the markets from the past 3 weeks and heading into the summer session.

Well NASDAQ hit a new high, markets moved higher and many earnings were reported. Avago bought Broadcom - a $37B acquisition (we think they paid too much - almost 5.5x sales) and then we have Intel buying ALTR this week - from an earnings we had HD, LOW and many other companies that reported earnings in the past couple of weeks. ULTA also reported but the stock reversed after reporting its earnings as did HD. There is talk of additional mergers in the semi company space - here are the companies that we think are ripe for consolidation - MXIM, IDTI, TXN, SLAB, MCHP, ADI, NVDA, AMD, SWKS, MRVL, XLNX, AMBA and probably many others we are missing. Keep an eye on these stocks. NXPI, AVGO, INTC and other big semi companies would be possible acquirers. With the AVGO and BRCM merger - the merged company will be the 3rd largest semiconductor company after INTC (1) and QCOM (2).

Our drug stock picks LLY, MYL and TEVA still holding strong. The biotech sector has been holding the NASDAQ up and we expect that this sector will eventually fall - we just cannot predict when - there is technical weakness in the ETFs in the biotech sector.

We are very concerned about the underlying weakness in the markets - structurally. We are seeing many stocks breaking down in the DOW and S&P500. In addition, stocks are reversing after reporting earnings - check HD, ULTA. Housing stocks are dropping - indicating that the markets are anticipating rate hikes from the Fed. We think the Fed sees an asset bubble and are being left with no choice but to start raising the Fed funds rate. Housing prices are moving up. unemployment is down to 5.3%, homes on the west coast are selling at prices higher than asking - and this has been the longest period for the rates being at near zero - now close to 6+ years and over the past week we posted an article on FB and G+ where Byron Wein discusses how the Fed has pumped over $3T into the markets - we concur. And then we see this article over the weekend:

All these are pointing to over valuation in the markets and the complacency is remarkable. The VIX was down last week and we expect this to spike higher in the coming weeks. We stated that we would take profits here and hedge positions with calls and puts. Adding some shorts is in our plan for the coming week. We are long BIDU, TWTR, Z (all hedged with covered calls) and are looking to short MSFT, and possibly IBM.

Just take a look at the stocks that popped on our sell signal strategy here:Just sort the page by volume from highest to lowest by clicking on the volume column twice:

Again - watch the Greek situation, China stock bubble, and sell here to take some profits and wait for a better opportunity.

Good luck trading. Check out our special subscription rates and we offer the best feature set on the web for our lowest subscription rates - here is the link:

Do checkout our backtest feature - it is the fastest on the web and ummatched by any site.

Link is: Backtest feature - play with it and you can use it to try some paper trades.

Please help by spreading the word of our site.

Trucharts founder and team

April 3, 2015

Jobs? Jobs? - what happened and what will the Fed do now??

Free Stock Chart - Trucharts.com - Technical Analysis, Predefined Scans, Screener.

JOBS JOBS and JOBS:

We are getting some good rest today from markets being closed for good Friday - but the job news for month of March was terrible - only 126000 jobs created versus the estimate of 248000 (BTW - that, as you can see, is a HUGE HUGE MISS) and Feb jobs report was revised down to 254000 from 295000. Stock futures dropped on the news - we will see what happens on Monday to the markets. Gold was up on the news - anticipating an accommodating monetary policy. It looks like the weather did impact this number, and the slowdown in the oil patch hiring affected this number. It also looks like the country has stopped hiring waiters and bartenders - there are only so many restaurants you can open!!

There is still a huge shortage of workers in the tech field and there are numerous jobs in the tech industry as is evident by the poaching going on in the tech industry and the abundance of openings (due to shortage of talent & experienced workers).

We still think the Fed will still stay on path for a rate increase in Sept - we think this is going to happen. This jobs report was very likely a one month blip and we will have to see 3 continuous months of this type of job creation numbers to see a trend and comment on the Fed response. We still think rates have been too low for too long and the Fed is very concerned about the bubbles in the economy. Have a happy Easter weekend.

We went long MO on Thursday - check the chart at - chart for MO

Other stocks of interest for next week: EXPE, SO, M, PHM, and TWTR and you can check other stocks on our Reports page at www.trucharts.com/marketreports.aspx

Trucharts Founder/CEO

JOBS JOBS and JOBS:

We are getting some good rest today from markets being closed for good Friday - but the job news for month of March was terrible - only 126000 jobs created versus the estimate of 248000 (BTW - that, as you can see, is a HUGE HUGE MISS) and Feb jobs report was revised down to 254000 from 295000. Stock futures dropped on the news - we will see what happens on Monday to the markets. Gold was up on the news - anticipating an accommodating monetary policy. It looks like the weather did impact this number, and the slowdown in the oil patch hiring affected this number. It also looks like the country has stopped hiring waiters and bartenders - there are only so many restaurants you can open!!

There is still a huge shortage of workers in the tech field and there are numerous jobs in the tech industry as is evident by the poaching going on in the tech industry and the abundance of openings (due to shortage of talent & experienced workers).

We still think the Fed will still stay on path for a rate increase in Sept - we think this is going to happen. This jobs report was very likely a one month blip and we will have to see 3 continuous months of this type of job creation numbers to see a trend and comment on the Fed response. We still think rates have been too low for too long and the Fed is very concerned about the bubbles in the economy. Have a happy Easter weekend.

We went long MO on Thursday - check the chart at - chart for MO

UPDATED:

Other stocks of interest for next week: EXPE, SO, M, PHM, and TWTR and you can check other stocks on our Reports page at www.trucharts.com/marketreports.aspx

Trucharts Founder/CEO

Subscribe to:

Comments (Atom)