Trucharts Blog week ending 11/28/2014

Well what a Thanksgiving week this was. New records were set and the S&P500 had a close over it's 5d SMA for 30 consecutive trading days - a new record. Stocks closed positive for the week and then we had the energy complex stocks getting completely crushed after the OPEC announcement from Saudi Arabia - no production cuts and crude oil suffered one of the biggest drops since 2008. In line with this drop, the other commodities got crushed - gold down, copper down etc., and the big rail stocks also dropped. We indicated that, we think, this was a political move by Saudi Arabia, pressured by US, to put the pressure on Russia and Iran - whose biggest revenue comes from oil exports. Obviously this is bad for all oil producing countries and good for possibly some oil importing countries like India/Japan and others. It will help reduce their account deficits and should be good for the consumer. Tech stocks, biotech and health care stocks did well - but then pulled back at the end of the week. We think the markets are definitely extended here and the move up has been nothing short of being historical. The ISEE P/C ratio closed at 74 on Friday and we expect the markets to pull back this week. We will very likely see a drop in the commodity stocks and the energy stocks. We expect that the drop in energy prices will definitely impact the local economies of Texas, Oklahoma, Louisiana, North Dakota and the shale producers. Expect gold to drop to $1000 and below. We are staying short the gold miners that are still overpriced relative to their peers. Short AEM.

Biotech stocks are definitely in bubble state and it is not clear how long this will last. We are seeing some cracks but not there yet. Market breadth is narrow - meaning that the number of stocks moving up by sector is narrow. Consumer retail stocks should do well with oil prices dropping. GM was up - but we think this will be shortlived - auto subprime loans hit a new historical high and auto inventory for GM dealers is also very high. Along with the issues with the ignition switches, this will impact their bottom line. We are going to watch this one closely and wait for the right moment to short.

We are long QIHU, CYBR, YELP, WSM, BIS, and short AEM, DAL (with tight stops) and IBB.

Below is the link for some good reading this week - a good article on the markets and their direction.

Another very interesting article on the nature of of US consumption and our values:

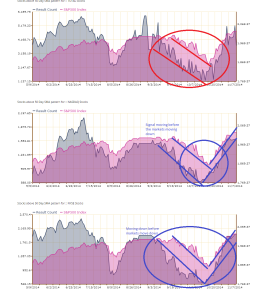

Here are some charts for your enjoyment (all montly) we would short the XLE based on monthly chart: