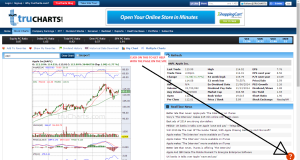

Trucharts.com Weekly blog week ending 01/02/2015

For SEO: Stock Charts Free, Charting, Stock Market, Technical Analysis, Stock Blog, Stock Buy and Sell Signals.

Happy New Year 2015 to all:

Market Stats: DOW 17832.99; S&P500: 2058.20; NASDAQ: 4726.81

| NYSE | Amex | NASDAQ |

| New Highs | 55 | 5 | 64 |

| New Lows | 23 | 5 | 31 |

| Up Volume | 1,317,747,081 (49%) | 54,149,125 (72%) | 640,070,736 (47%) |

| Down Volume | 1,361,184,794 (50%) | 18,108,068 (24%) | 714,790,713 (52%) |

| Unchanged Volume | 31,963,947 (1%) | 2,449,256 (3%) | 11,961,935 (1%) |

| Total Volume | 2,710,895,822 | 74,706,449 | 1,366,823,384 |

New Year and new resolutions - I am sure Yellen and the Fed have their resolutions already in place - we think there resolution is keep economy on track and no need to raise rates - the dollar strength and weakening economies around the world will bolster the demand for US $ and US bonds - we do not see the bond bubble imploding (at keast yet). Seeing the oil collapse and the Russian ruble collapse is making the US dollar gain more strength and we suspect the Chinese RMB will get weaker - with the Chinese economy slowing - the Chinese will have no choice but to allow the RMB to weaken and make their exports competitive and with the Chinese economy driven by exports to EU and other nations with weakening currencies and economies - the RMB has to fall further. That is our prediction for 2015 - what does this do to gold - with energy prices down we expect gold to drop also - but we will have to keep an eye on this - gold may also become the currency of choice - a tricky catch 22 situation. Oil drop is, we believe, a political driven drop and maybe mixed in with a hint of over-supply. This is affecting major economies like Russia, Venezuela and other major oil-producing nations. We expect oil to be range bound between $45-$70. We went long USO and LINE this week. The economies of US states like Texas, Oklahoma, ND will be affected by this drop in oil price - we will have to see the impact.

Fed action - we do not expect any rate hikes this year as we stated earlier.

Stock bubbles and valuations - There is no doubt we are in a stock bubble - the accounting shenanigans, stock buybacks help moved the stock prices and earnings. Many stocks and sectors are trading at above average PEs - with the Fed holding back on raising rates, we expect stocks to possibly rise this year as there are almost no alternatives to make a decent return. Stocks look extended short-term and we expect a pullback here and will have to keep a close eye on the earnings and forward forecasts for Q1. Semi stocks were downgraded last qtr by BofA Merrill Lynch and this a sign that the semi stocks have had a nice long bull run and we would expect a pullback. Keep an eye on the following stocks SWKS, TXN, ALTR, XLXN, SYNA, MXIM, SIMO etc.

VC funding and company valuations are still outrageous and it smells a lot like 1999.

We also expect major dividend cuts from the energy sector stocks - so please keep a close eye on your small to mid-sized oil and energy stocks with current high payout and high dividend payments - these will definitely impact the stocks prices.

Consumer staple stocks and retail stocks are holding up well and we expect the retail sector to show decent earnings. There have not been any major warnings to date - with the gas prices at the pump dropping, we expect that consumers used this opportunity to spend more on gifts etc during this Christmas season.

Utility stocks had a huge run due to the drop in bond yields and we need to keep an eye on these - there was pullback on Friday - but we expect that this sector will still be strong this year unless there is a bond rout.

We will be publishing the definitions and charts for all the indicators on our site soon.

Check out this stock LINE which we went long for a short term trade: www.trucharts.com/stockview.aspx?TICK=LINE.

Gold miner stocks were up on Friday - keep an eye on GDX, GDXJ.

Trucharts positions: Short GM (due to recall), technically stock extended, ALTR, DAL, IBB, AEM. Long USO, CYBR, WSM, K, HMY, LINE.

Best of luck for 2015 and use our site for auto buy/sell signal strategies and as we keep making improvements, we will keep you posted.

Thanks and please help us spread the word - our subscription price is one of the lowest and best in the industry for the type of information we provide to our users and if you have any ideas for improvements or information you would like us to add, please email our CEO and founder directly at bbhatia@trucharts.com - we look forward to your comments and feedback.

Trucharts Team