Trucharts.com Blog week ending 3/20/2015

Where are the markets headed this coming week and what are the hot stocks to watch this week.

The Fed spoke and the markets rocketed higher last week and gold moved higher and stocks responded positively to the Fed comments - bonds moved higher and yields dropped, the dollar was crushed for a short time and then bounced back. We still like the US dollar and we expect the Euro to head lower. The Fed is cornered and scared to do anything to upset the markets - and they are into playing 'WORD' games - patient and impatient etc. It is truly absurd how the markets are so hung up on words from the Fed. The markets were driven down heading into the Fed meeting and then the VIX got crushed and all the market indices rocketed higher right after the Fed meeting. Basically the Fed said they will not raise rates in June - something that was not surprising to us - we do not expect the Fed to raise rates at all this year even though there is lot of jawboning going on by the Fed and it's governors.

The DOW JONES INDUSTRIALS climbed above the 18K number - NASDAQ buoyed by the flaming biotech stocks and semiconductor stocks breached the 5000 mark and has everyone now waiting and talking about breaking the 2000 high - which we expect is coming to get all the news talking heads excited and bubbling with joy.

Biotech stocks the darlings of Wall Street are having price movements like the internet stocks of 2000 - we do not know when or how this is going to end - companies are buying other smaller rivals or companies with potential blockbuster drugs - and this can last as long as we are in this Fed driven rally and a zero interest rate environment - which says keep taking risks until We (the FED) says time out.

Technically speaking even though the RSI and MACD are exhibiting lower highs with this move up - the patterns seems to indicate higher highs. The NASDAQ is technically broken out to a new high. There maybe some pullbacks (consolidation) - but the trend is for higher highs. We are heading into earnings reporting season and need to be on guard for any potential earnings warnings - please keep these in mind prior to taking any big positions or longer term bullish positions.

AAPL was integrated into the DOW Industrials this week and is a Dow component now. We would be watchful of AAPL here. SBUX announced a stock split this week and SWKS, NXPI and AVGO hit brand new all time highs. Check out our reports page at www.trucharts.com/marketreports.aspx for stock lists with technical breakouts etc.

The biotech sector is on fire and we were wrong on our call in this sector but still believe that this sector is definitely overextended - but right now the sector is still in the hands of the bulls - just check stocks like www.trucharts.com/stockview.asp?TICK=REGN - please check the stock from period 2000 to now and you will see what we mean by exponential moves.

Stocks we picked last week - LLY and SO, PCG did well during this week and LLY was up over $6 from our pick price.

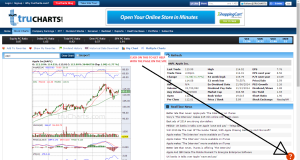

Stocks we like this week - TWTR, MYL and TEVA - we will be watching these closely and be looking to go long TWTR. Here are the weekly charts (TEVA is breaking out):

Good luck trading.

Trucharts.com team and Founder