Tech Stocks - Alibaba (BABA) and China/Semiconductor Stocks

First disclosure - We missed this bubble and are really upset that we missed it - made money in the last two bubbles but did not see this one even though it was staring us straight in the eyes. But this was an important lesson learned and a very expensive one at that. We missed many amazing stocks and that is what upsets us the most.. Truly disappointing..Now back to the markets:What a run up - absolutely amazing - it was a classic up move from a huge pullback from earlier in the year. Every stock was just going up, up and up. There was no stopping the BULL train and indices hitting new highs - many stocks hitting new highs - company valuations crossing $1Trillion - bigger than the GDP of many nations put together.. Yet not one analyst or talking head or journalist (except that 1%) were willing to utter the word BUBBLE. New startups being valued at numbers that exceed the 2000 bubble, funding at levels not seen even in 2000 - Idiot Masayoshi - raising 100B funds like candy.. These are the signs of bubbles - not a single soul is scared or even concerned - margin debt at all time highs. P/S of companies at records - companies making no money being funded as they are going to make BILLIONS.. We have to say these are all signs we have seen and witnessed before and these never end nicely.. We have become addicted to bubbles and we have now perpetuated 3 within a span of 18 years - that is unheard of. Massive money printing and FOMO amongst the VCS, the investing public and machines doing the trading has led to this excess of massive proportions. There is not a single day when a company is going public - which is a sign the smart money (VCs) are cashing out - while everyone is high and drunk.. Some examples of stocks trading at ridiculous P/S - NOW - over 18x P/S; ETSY - over 14x P/S; and there are many more. The numbers of companies trading at these type of valuations is absolutely staggering. And every new company has now a valuation above $1B - it is an absolute joke - NVDA trading at over 170B market cap and P/S of over 15 for a semiconductor company - that is unheard of in the history of semi companies. Full disclosure - we are short NVDA.Here is a comment from ex CEO Scott McNealy from good old Sun Microsystems which eventually went out of business: read the words - they are actually amazing from a valuation perspective:

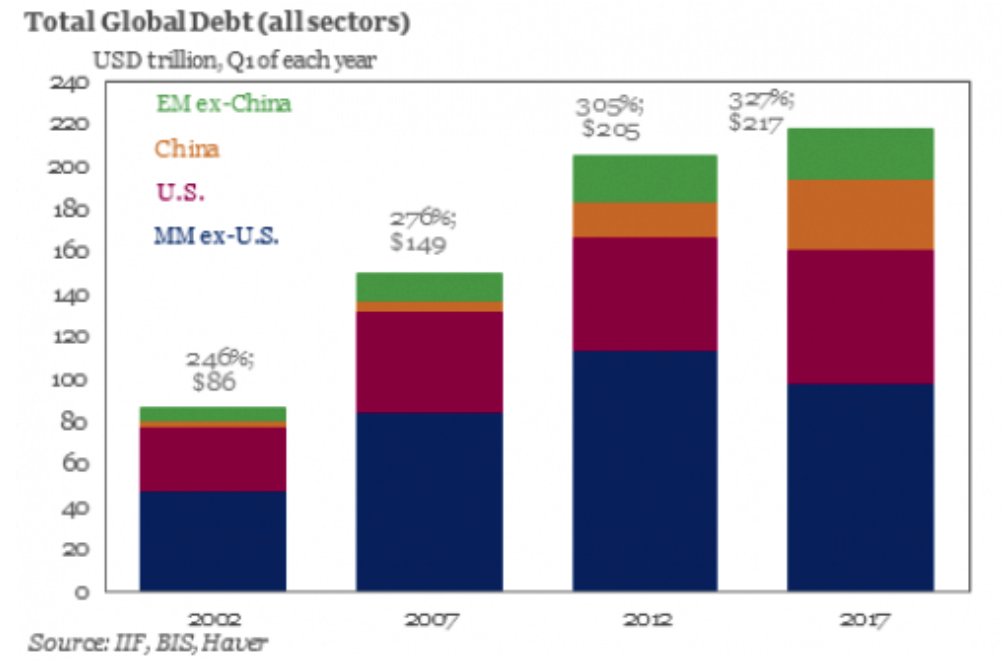

Anyway we can go on and on and now the 10Y Treasury is yielding over 25 bp over 3% and heading higher. Housing bubbles are cracking in many parts of the world - India, Australia, Canada, Hong Kong, New York, Denver and many other locations are starting to breakdown from this incessant building of homes and apartments (flats as they are known abroad)You can only blow a bubble so big before it eventually explodes.. And the Fed and the world are all addicted to bubbles. We have huge issues with pensions all around the world - debt to GDP ratios at extremes and student loans, auto loans (with high car payments ever and highest number of payback years). Credit card debt at extremes and everyone is loaded with debt - this is unsustainable. The Indian banking system which was flush with loose money and corrupt insiders is now unraveling at a rapid pace and the INR is dropping to record lows while the markets are finally coming down. We think there may be a reset - do not know when and how - but something has to give because we have gone past the limits of what makes sense. It would have been better if the central banks had a good plan and approach to the crisis and managed it in a much slower and better fashion - but that is not what happened - they turned on the tap at full speed and now what we are experiencing is the overflow effects with no control left. It is like unleashing a monster.. If they would have taken a slow and gradual approach we would not be where we are today - staring down another bubble.. Unfortunately we want quick fixes and have been addicted to these bubble methods - which in the end always lead to busts.. This bust will last longer then anytime before and it will not be pretty. Just wanted to pen down our thoughts this week.We would sell the stocks like BABA - broken down and many tech stocks are finally breaking the 200d SMAs (some have already done so and have gone down since - look at MCHP and now we expect the same for TXN and BIDU etc.) So buy and hold works great when everything moves up in tandem but fails when things go sideways and/or start to breakdown.. We will update more next week. We are recommending short on ETSY and ROKU.

There is some exciting news coming from our site/platform - keep tuned..Good luck trading.

Founder Trucharts.com/Co-founder JETSTOX.com