Trucharts.com Blog week ending 1/16/2015.

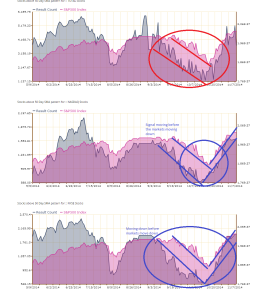

Happy MLK day - markets were closed today - but what a closing on Friday almost 8:2 advancers vs decliners on NYSE and NASDAQ - we suspect short covering rally and short term oversold conditions - but technically the markets look weak and we had a 13d SMA crossing the 50dSMA for the indices - we expect a bounce to the 50d SMA - we had a strong close and gold moving higher, along with oil. And then we had the Dutch cut their interest rates to -ve. SO we pay the banks money to hold cash - think about that for a second - you pay the bank to hold your money - wow!! Then there is the expectation that the ECB will unleash another round of QE - when are the idiots in the Eurozone get it through their thick skulls - QE does nothing in a heavily taxed and socialistic government structure - reduce taxes and act like Ronald Reagan and let's see what happens - really dumb people lining their pockets. So stupid.

Today China reported the GDP number - 7.4% and then yesterday the markets in China got crushed as China pricked the stock bubble by regulating margin accounts which were non-compliant to the capital requirements. Now everyone expects China to unleash another round of stimulus. The whole world and asset prices are now running on steroids - that is what I call QE and all these stimulus injections into the economy - eventually these will hurt and the central banks are scared shit. Gold is the real currency and there is now a currency war in play an oil glut and stocks/real estate in bubbles everywhere. We never seem to learn from our mistakes.

This will be the start of the earnings barrage week - check the earnings calendar on our site at: http://www.trucharts.com/EarningsView.aspx

We closed our ALTR calls last week - our call on ALTR short was correct.

DAL - we sold puts for Jan 30 for 44 strike - we are still short DA and the 44 puts, GM and F.

Our GM call spread for 34.5 and 36.5 expired worthless. Our stock K is doing well and we are long WSM, TWTR, CYBR, USO and ANV. We still like gold here because it broke through resistance and the Chinese New Year is in February.

Here are some good picks for the coming week -

XLU (www.trucharts.com/stockview.aspx?TICK=XLU); Other stocks (www.trucharts.com/stockview.aspx?TICK=SO) - the utility stocks look good in this falling interest rate environment. Our call on HELE was good - still looks strong.

Chart of GRMN here below - looks good technically for a short term trade: